Business Insurance in and around Bedford

Calling all small business owners of Bedford!

No funny business here

State Farm Understands Small Businesses.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes problems like an employee getting injured can happen on your business's property.

Calling all small business owners of Bedford!

No funny business here

Insurance Designed For Small Business

No one knows what tomorrow will bring—especially in the business world. Since even your brightest plans can't predict consumer demand or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like worker's compensation for your employees and a surety or fidelity bond. Terrific coverage like this is why Bedford business owners choose State Farm insurance. State Farm agent Michael Meehan can help design a policy for the level of coverage you have in mind. If troubles find you, Michael Meehan can be there to help you file your claim and help your business life go right again.

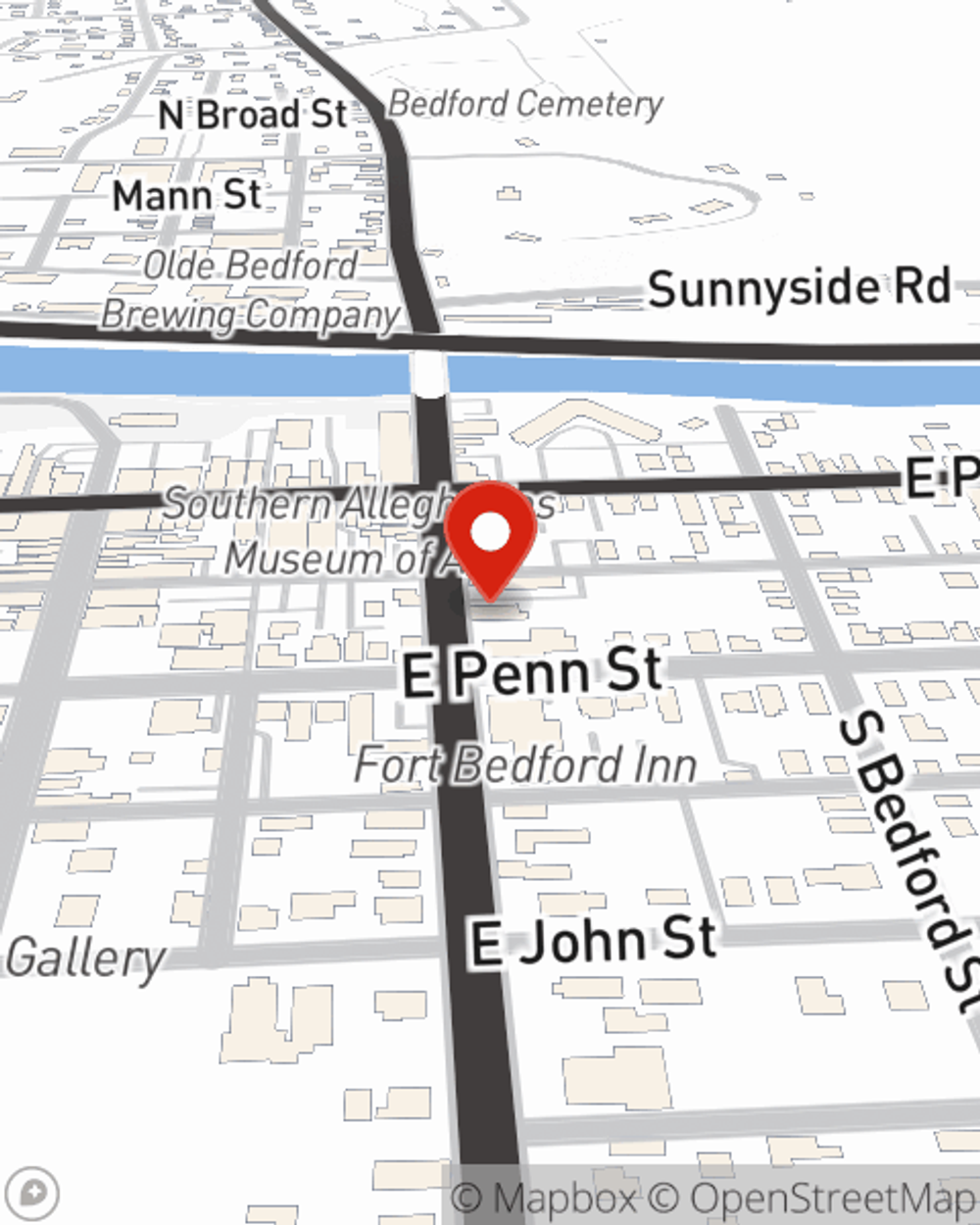

Take the next step of preparation and get in touch with State Farm agent Michael Meehan's team. They're happy to help you explore the options that may be right for you and your small business!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Michael Meehan

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.