Homeowners Insurance in and around Bedford

Looking for homeowners insurance in Bedford?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

One of the most important actions you can take for your family is to get homeowners insurance through State Farm. This way you can take it easy knowing that your home is protected.

Looking for homeowners insurance in Bedford?

The key to great homeowners insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

Michael Meehan will help you feel right at home by getting you set up with great insurance that fits your needs. State Farm's homeowners insurance not only covers the structure of your home, but can also protect prized possessions like your mementos.

Whether you're prepared for it or not, the unexpected can happen. But with State Farm, you're always prepared, so you can laugh and play knowing that your belongings are secure. Additionally, if you also insure your vehicle, you could bundle and save! Contact agent Michael Meehan today to go over your options.

Have More Questions About Homeowners Insurance?

Call Michael at (814) 623-8165 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips to help prevent burglary

Tips to help prevent burglary

Consider these home burglary prevention ideas to help protect your home.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

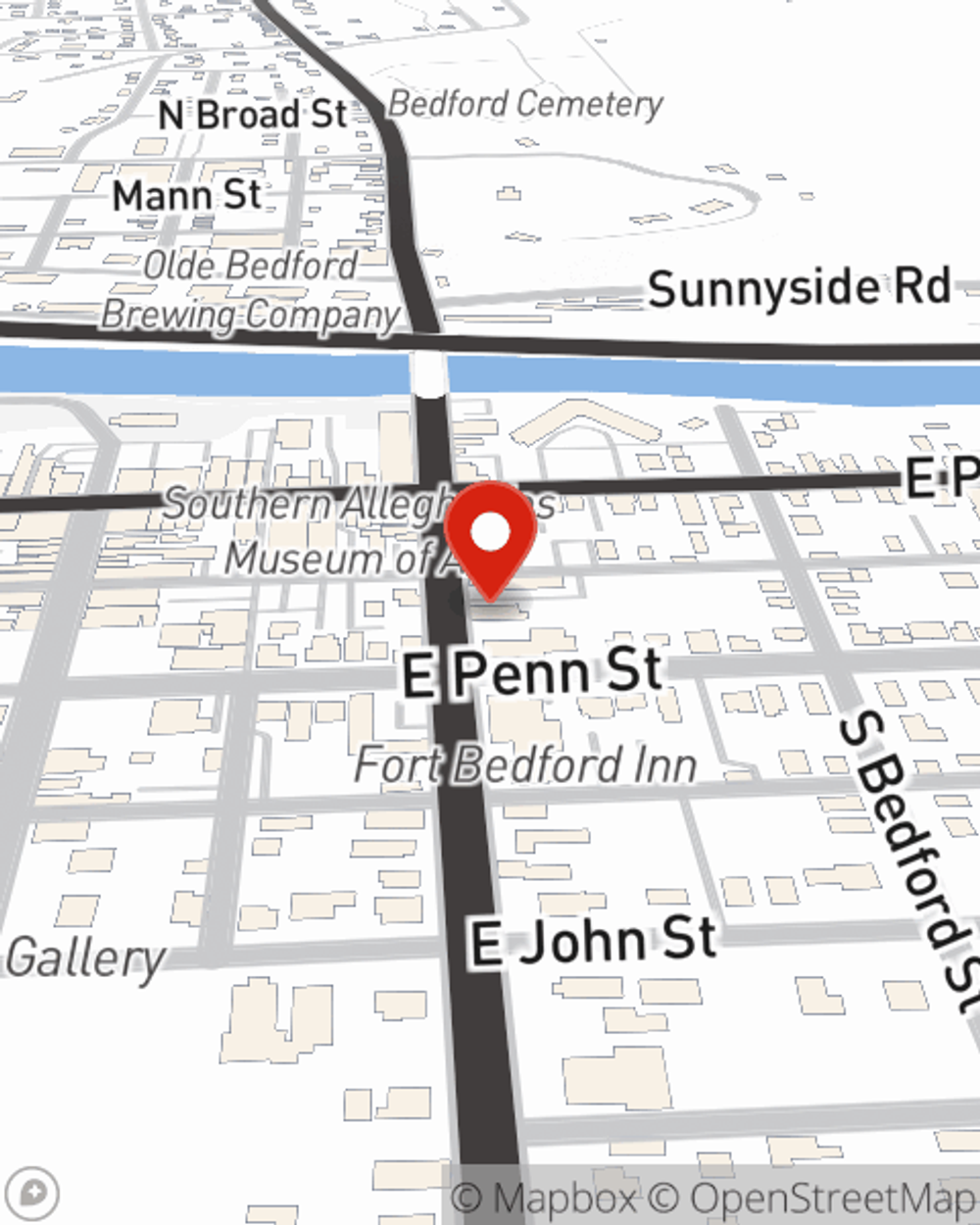

Michael Meehan

State Farm® Insurance AgentSimple Insights®

Tips to help prevent burglary

Tips to help prevent burglary

Consider these home burglary prevention ideas to help protect your home.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.